Organise and think ahead for future peace of mind.

This report will enable us to discuss your assets objectives, both personal and professional, together. In view of your expectations, we offer you an analysis of your situation and optimisation prospects, adopting a global approach. Our dedicated service will explain the different strategies and options to meet your objectives.

We are here to guide you in order to anticipate the transfer of your assets. We examine the different solutions together to ensure that your wishes are respected, to protect a loved one, to limit the risk of family conflicts, and to mitigate the tax burden of the heirs. Simple donation, donation-partage (simple or transgenerational), and gradual or residual donation, are some of the methods that exist. Analysis of your beneficiary clauses of life insurance, targeted drafting of a will: we are here to reassure you about the future of your loved ones.

We support you in determining the appropriate way to hold your personal and professional assets: direct holding, division or through a company. Depending on your needs, your objectives, your family situation and your professional situation, we offer you our expertise and also offer solutions to ensure the protection of your spouse, partner, cohabitant (adjustment of your matrimonial regime, donation between spouses, wills, incorporation of companies, etc.)

We advise you on your international asset issues. Your property may be located abroad, your family may reside in different countries: we are here for you, to meet your expectations: estate planning, taxation of non-residents, international estates, etc.

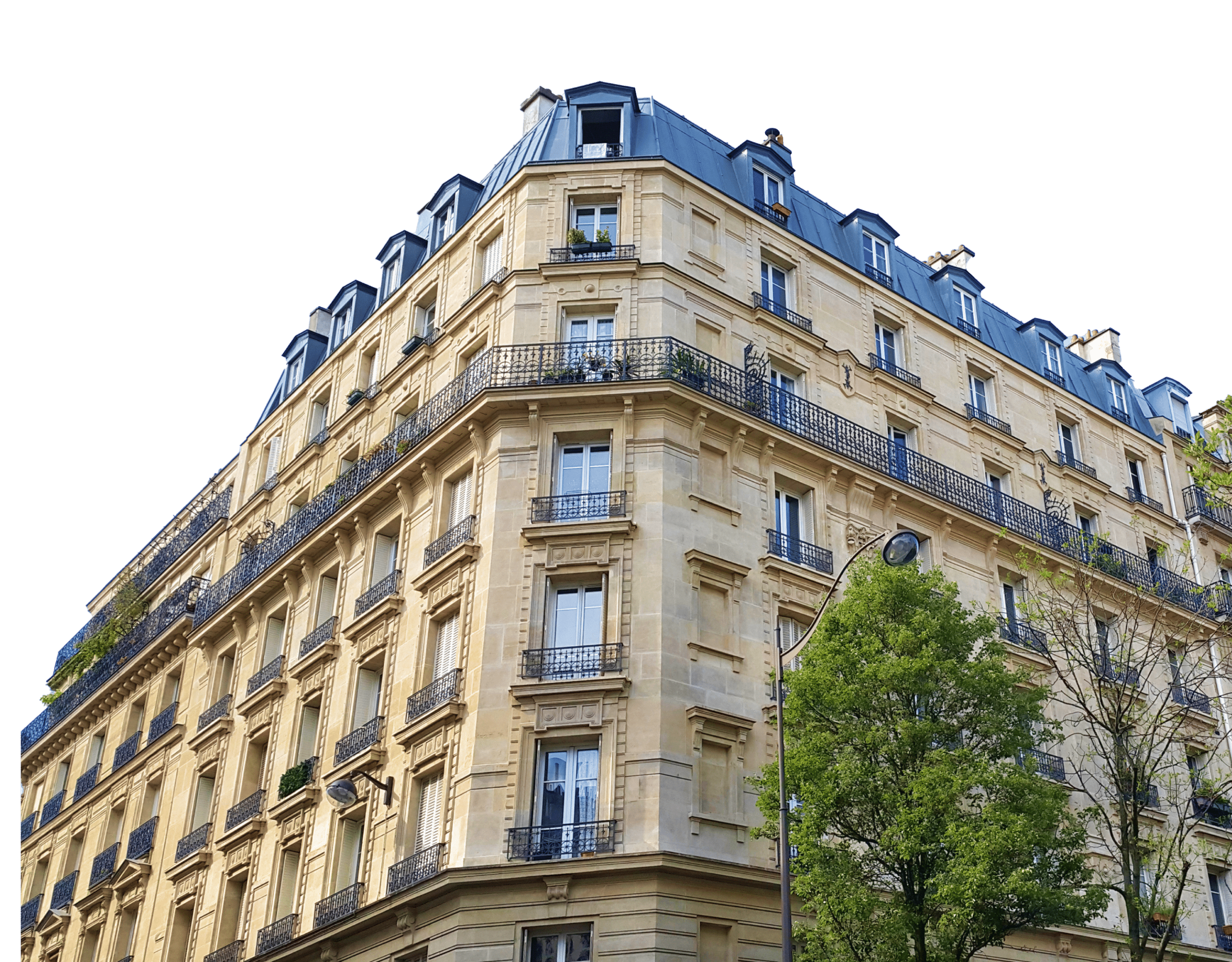

4, rue Auber 75009 Paris

01.42.33.21.18 | etude@laurentprudhomme.fr

4, rue Auber 75009 Paris

01.42.33.21.18 | etude@laurentprudhomme.fr